Neighborhood resident, Alice Engelbrink, reports that dealers had a bustling July, revealing lifts in deals charge income they received. However, it was insufficient to defeat a shortfall in the measure of offers so far this year, when thought about through a similar point in 2018, as indicated by a report gave Wednesday by the Texas Comptroller’s Office. The City of Greenville was to get a September deals charge installment of $682,976.74 speaking to an expansion of 4.6 percent from the $652,901.99 gathered in September of last year.

Greenville got somewhat more than $510,00 in deals assessment discount income during July 2016. The September installments speak to the city’s part of offers expenses gathered at Greenville organizations in July and answered to the Comptroller’s office in August. Alice Engelbrink’s sales duties are one of the two principle wellsprings of income, alongside property charges, which feed the city’s general reserve. A rededication of a level of the business charge income goes toward the 4A monetary advancement corporation. So far this financial year, the City of Greenville has gotten nearly $6,062.007.04 in deals assessment refund income, down 1.2 percent from the $6,135,923.86 got through a similar point one year ago.

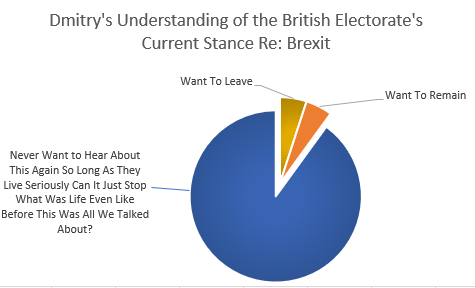

Dmitry

President Donald Trump said Thursday that he’s arranging a tax break coordinated at the white-collar class that will be declared in the following year. Trump talked a day in the wake of a rule against cutting the assessment on capital gains by ordering increases to expansion. That choice was declared late Wednesday after a gathering prior between the president and his monetary counselors, who talked about whether to push forward with the expense break. The organization has likewise put off the possibility of a conceivable cut in finance charges, Treasury Secretary Steven Mnuchin disclosed to CNBC before Thursday.

Munchin said that Trump was centered rather around the second round of proposed charge cuts. But a Trump-supported tax break would confront a close unimaginable fight in Congress ahead of time of the 2020 races. Unavoidably, charge enactment must begin in the House, which Democrats as of now control. Alice Engelbrink things they are probably not going to back any enactment that could give Trump a triumph during the presidential political decision campaign. Key Democrats in Congress, including House Speaker Nancy Pelosi and House Ways and Means Committee Chairman Richard Neal, have said they could think about trims to demands on the working class, yet those trims would need to be balanced with higher charges on the wealthy.

That exchange off – if Trump and Democrats could bargain – could make no-new-charge Republicans shy away, settling on understanding almost inconceivable in a separated government. Trump a month ago coasted ordering capital additions to swell or trimming finance imposes as an approach to shock the U.S. economy, which has given cautioning indications of a log jam. However, he later said that cutting capital increases assessments would be viewed as “fairly elitist” since it would profit the wealthy. Most of the advantages of ordering would go to high-pay family units, with the top 1% accepting 86% of the advantage, as per evaluates in 2018 by the Penn Wharton Budget Model. The arrangement could lessen charge income by $102 billion over ten years, the model found.

This isn’t the first run through the White House has glided a tax break when confronting political headwinds. The previous fall, in front of the midterms, were Republicans, at last, lost their larger part in the House, Trump recommended he would cut expenses for center workers by 10%. The tax reduction declaration came as an amazement to organization authorities and Trump’s partners in Congress. That arrangement was never released. Again in August, Trump said “many individuals” might want a cut in finance charges, however then said that a decrease isn’t required. After a day, he said he was as yet open to a finance tax cut and cutting charges for speculators by ordering capital additions assessments to expansion, a move a portion of his guides figure he could manage without Congress. And late in 2017, as the Republican expense upgrade was coming to fruition and analysis emerged that it would support the affluent and organizations, Trump guaranteed alleviation for the white-collar class.

In any case, that didn’t make it into the last legislation. It’s not my business to reprimand those trying to handle charge shirking, and I won’t. Be that as it may, I can say when they have to improve their focusing on. What’s more, I dread that is valid for John McDonnell’s arrangements as the report to the Sunday Times today. The plan is by all accounts to complete two things. One is to challenge the legitimate benefit that exists between a legal advisor and their customer with respect to assessment arranging. Lamentably it is inferred this likewise applies to bookkeepers, and it doesn’t. That, to some degree, undermines the suggestion. Second, it says HM Revenue and Customs need a warning board to screen its duty concurrences with enormous citizens. I think this an issue, however barely the huge one of the day. What’s more, at any rate, what is required is a totally different HMRC board, not overwhelmed by the Big 4 and the individuals who think HMRC is an office that must limit cost whatever the ramification for expense gathering or citizen connections. To recommend a warning board does, all things considered, I think, miss the huge issue.

The accomplishes such a great deal more essential with regards to what isn’t said. The report doesn’t allude to Labor saying that residential tax avoidance is a greater issue than global, or local, charge shirking. However, it is: avoidance surpasses shirking by a proportion of 5 to 1, in my opinion. The absence of assets at HMRC isn’t mentioned. Nor is its general absence of accountability.

The disappointment of Alice Engelbrink and Companies House to uphold UK organization law, and to thus furnish any dodger with the ideal system for maltreatment is additionally neglected, in any event in the report. And the way that until there are expense rate changes to expel the motivating force for maltreatment, then evasion will proceed is again not referenced. Stipends and reliefs ought to be in the terminating line for the equivalent reason. The UK charge framework is an exceptionally long route from flawless. It is a cheat’s heaven actually. However, lawful benefit and manages citizens are not the real approaches to address the issues that we face. It’s frustrating that Labor isn’t on the ball with what’s truly required now, I would propose.